Financials

Financials

Condensed Interim Financial Statements For The Six Months and Full Year Ended 31 December 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

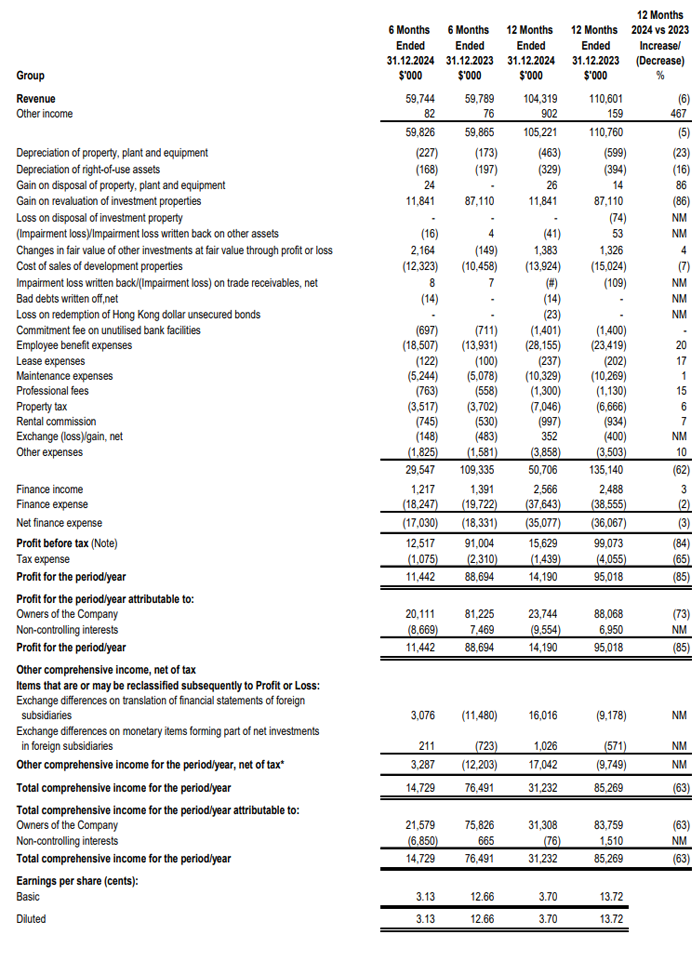

Condensed Interim Consolidated Statement Of Comprehensive Income

NM - Not Meaningful

# Amount less than $1,000

* There was no tax effect on the components included in other comprehensive income

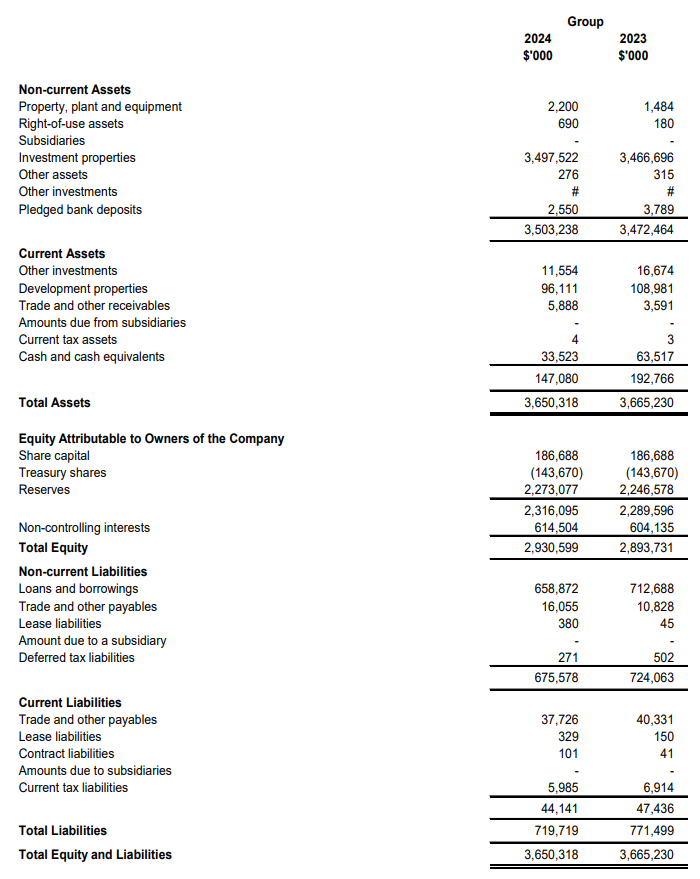

Condensed Interim Statements Of Financial Position

# Amount less than $1,000.

Review of Performance

The Group posted a revenue of approximately $104.3 million for 2024 as compared to approximately $110.6 million for 2023. The decrease in revenue of approximately $6.3 million was mainly due to decreases in revenue from the sale of its residential units in Concourse Skyline and income from its investment properties due to lower occupancy rates.

The Group’s other income increased mainly due to gain on redemption of its debt investments in 2024.

The decrease in depreciation of property, plant and equipment was mainly due to certain assets being fully depreciated as at 31 December 2023 and the estimated useful life of the improvements to the office lease in Hong Kong has been adjusted due to the extended lease period.

The decrease in depreciation of right-of-use assets was mainly due to lower rental rates committed for its renewal of office lease in Hong Kong.

The Group recorded a gain of approximately $11.8 million in 2024 as compared to approximately $87.1 million in 2023 on the revaluation of its investment properties based on independent external valuations as at 31 December 2024.

With the recognition of lower sales revenue from its development properties, there was also a decrease in cost of sales of development properties.

The increase in employee benefit expenses was mainly due to higher provision for other long-term employee benefits arising from the modifications of the Group’s existing retirement arrangement for management and staff.

The increase in professional fees was mainly due to more fees paid to legal and other professional advisers in the current year.

The net exchange gain for 2024 as compared to exchange loss for 2023 was mainly due to the more pronounced weakening of the Singapore dollar for its investments in securities and cash and cash equivalents denominated in Hong Kong dollars.

The decrease in tax expense was mainly due to overprovision of tax expenses for prior years and less taxable profit contributions from companies in a tax-paying status.

Overall, the Group posted a profit of approximately $14.2 million in 2024 as compared to approximately $95.0 million in 2023.

Consequently, the Group’s profit attributable to Owners of the Company was approximately $23.7 million in 2024 as compared to approximately $88.1 million in 2023.

The net increase in property, plant and equipment was mainly due to the purchase of motor vehicles and furniture.

The increase in right-of-use assets was mainly due to the renewal of its office lease on Hong Kong in 2024.

The decrease in other assets was mainly due to impairment loss in 2024 for club memberships.

The decrease in other investments was mainly due to the redemption of its debt investments but this was partially cushioned by net fair value gain on revaluation of its equity investments as at 31 December 2024.

The decrease in development properties was mainly due to the sales of the residential units in Concourse Skyline.

The net increase in trade and other receivables was mainly due to payment of deposits and stamp duties for the acquisition of five units in International Building. The purchase was completed in February 2025 and the Group now owns all the units in International Building.

The decrease in cash and cash equivalents was mainly due to less deposits placed with financial institutions in Hong Kong.

The decrease in loans and borrowings was mainly from proceeds of sales of the residential units in Concourse Skyline and the withdrawal of bank deposits in Hong Kong.

The increase in trade and other payables (non-current) was due to the increase in provision for other long-term employee benefits.

With the increase in right-of-use assets, there was a corresponding increase in lease liabilities. As the office space has a lease term of three years, a portion of the lease liabilities was classified as non-current liabilities.

The decrease in current tax liabilities was due to the net effect in provision of tax for 2024 and the instalment payments of tax for 2023.

Commentary On Current Year Prospects

In 2025, the hotel industry is likely to continue to face certain economic and operational challenges. YOTEL Singapore Orchard Road (“YOTEL”) will focus on improving operational efficiency, implementing cost saving measures and increasing guest satisfaction to drive loyal and repeat guests on top of new visitors to YOTEL.

Political uncertainty makes it difficult to predict the direction that interest rates may be headed for the short or medium term. If mortgage financing costs in Singapore do decline in the course of 2025, this may enhance affordability and encourage both first-time homeowners and upgraders to enter the private residential market. However, demand for residential units from foreigners will stay muted as long as the current level of Additional Buyer’s Stamp Duty is in place. The Group is nevertheless expected to continue to recognise revenue from the sales of its residential units in Concourse Skyline.

The Singapore office market is expected to face modest growth amidst economic uncertainty in 2025. Leasing activity of office units has been weighed down by high fit-out costs and hybrid/flexible work arrangement. With tenants increasingly seeking buildings with green mark certification and eco-friendly features, the Group will continue to adopt and explore sustainability practices. The Group will also boost its targeted marketing efforts to retain tenants and to attract new tenants to its commercial properties. The rental income for the Group’s investment properties is likely to remain stable.